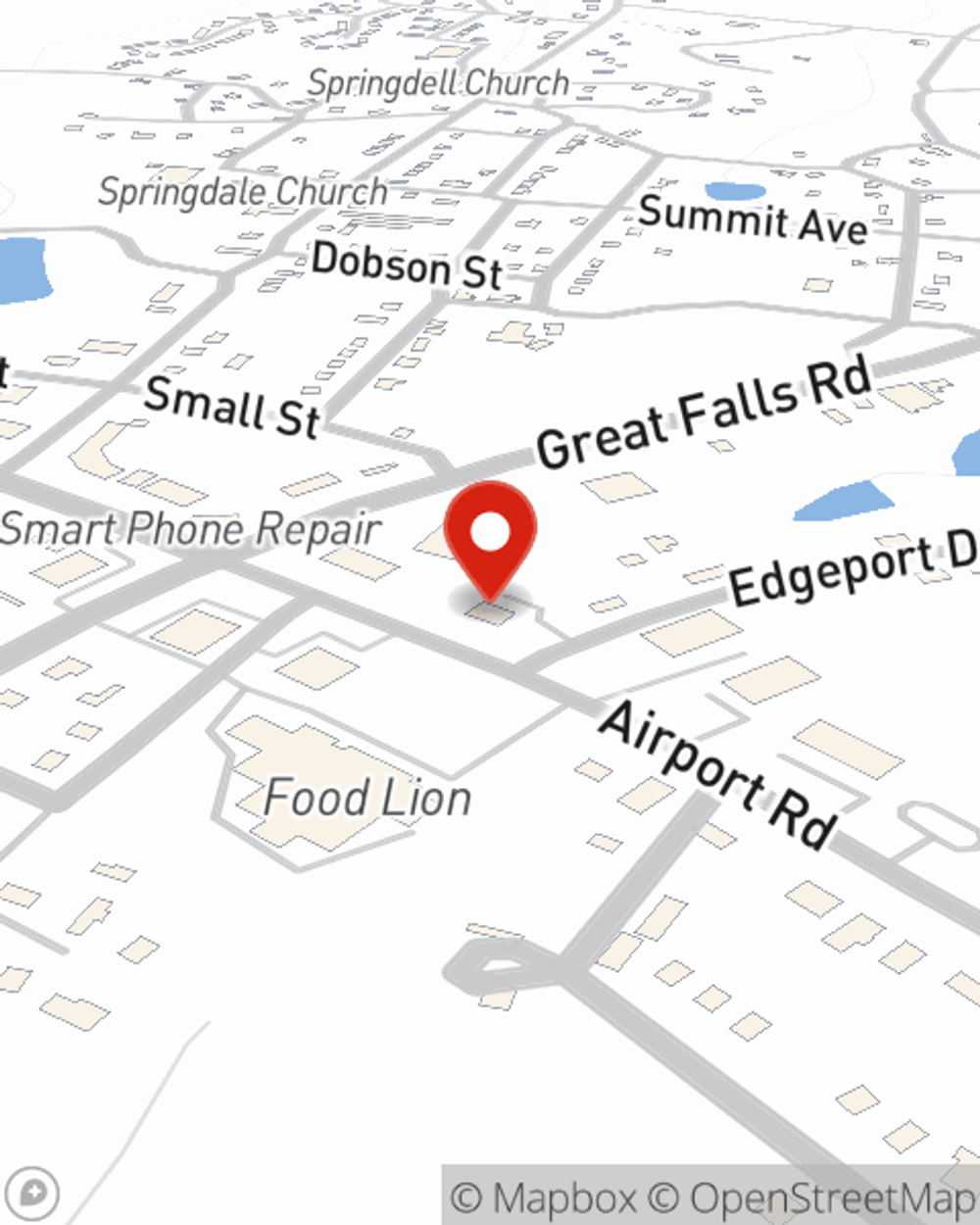

Life Insurance in and around Lancaster

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Lancaster

- Fort Mill

- Indian Land

- Lancaster County

- Rock Hill

- Heath Springs

- York

- Kershaw

- Pageland

- Great Falls

- Van Wyck

- Winnsboro

- Sumter

- Fort Lawn

- York County

- Chester County

- Richland County

- Kershaw County

- Cheraw

It's Time To Think Life Insurance

It can be a big deal to provide for those closest to you, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your loved ones can pay off debts and/or pay for college as they face the grief and pain of your loss.

Protection for those you care about

Don't delay your search for Life insurance

Their Future Is Safe With State Farm

And State Farm Agent Andrew Berks is ready to help design a policy to meet you specific needs, whether you want coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in exploring what State Farm can do for you? Visit agent Andrew Berks today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call Andrew at (803) 286-5546 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Andrew Berks

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.